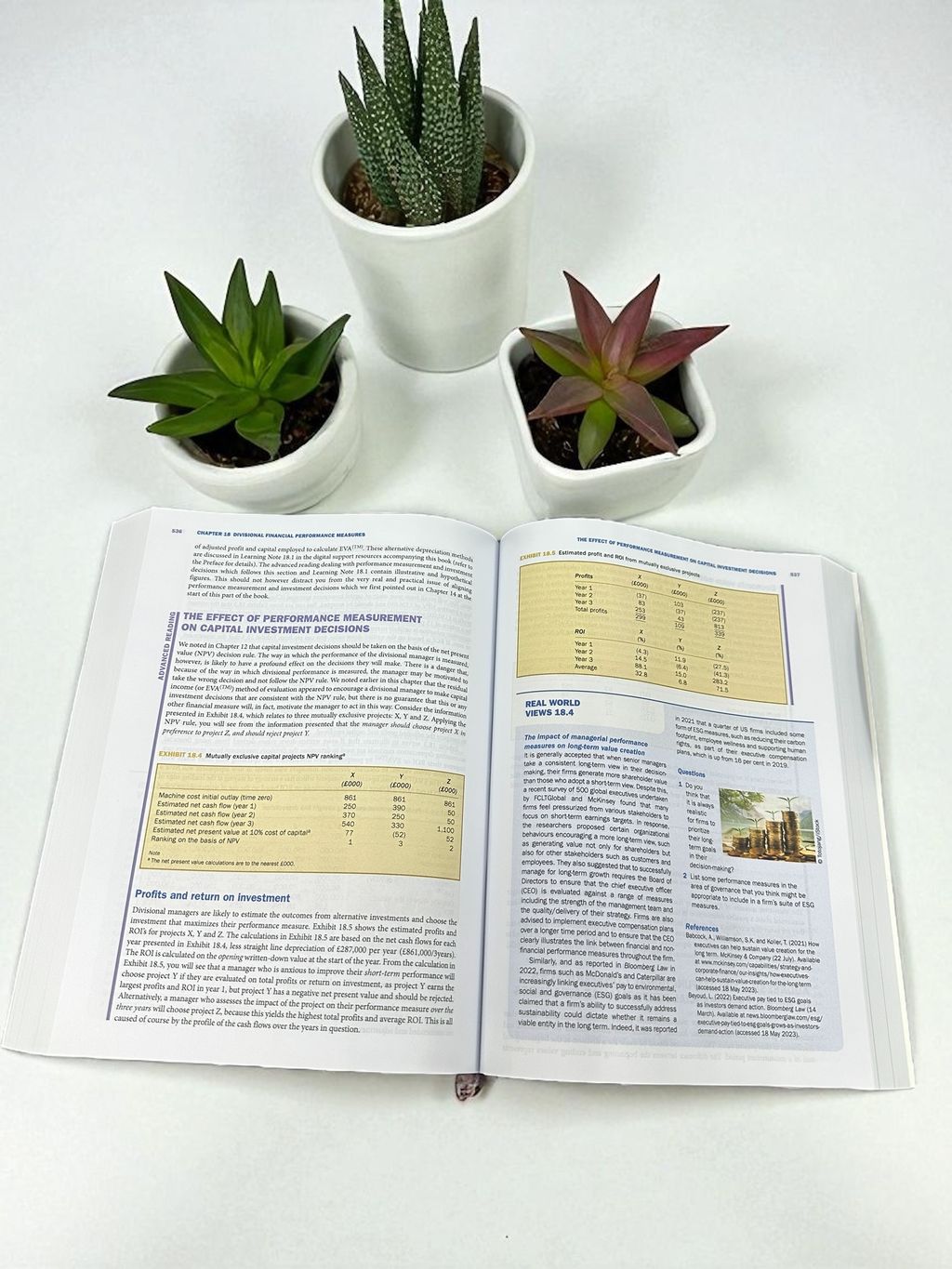

Colin Drury, Management and Cost Accounting, 12th Edition

- Regular price

- RM 194.00

- Sale price

- RM 194.00

- Regular price

-

RM 0.00

Share

Management and Cost Accounting, 12th Edition

Colin Drury, Mike E Tayles

Copyright 2024 | 896 pages

- Detailed examples explain management accounting theory and practice step by step.

- Updated, timely Real World Views bring accounting theory to life and introduce students to practical applications.

- Extensive end-of-chapter questions with varying difficulty-levels reinforce the material covered and prepare your students for professional exams.

- Employability skills exercises in every chapter expand students’ practical IT and presentation skills for their future careers.

Whats is new?

- A new chapter on management accounting in the digital age including data analytics explains big data, AI, blockchain, robotic process automation and cryptocurrency.

- Increased coverage of environmental management accounting and management control systems includes the changing landscape of the management accountant’s role.

- Numerous new Real World Views on topics such as passenger delays at airports, food pricing and AI for accounting show accounting in practice in recognizable companies featuring Amazon, Apple, Netflix and easyJet.

Table of Content

Part 1: Introduction to MCA

1. Introduction to MA

2. An introduction to cost terms and concepts

Part 2: Cost accumulation for inventory valuation and profit measurement

3. Cost assignment

4. Process costing

5. Joint and by-product costing

6. Income effects of alternative cost accumulation systems

Part 3: Information for decision-making

7. Cost-volume-profit analysis

8. Measuring relevant costs and revenues for decision-making

9. Pricing decisions and profitability analysis

10. Activity-based costing

11. Decision-making under conditions of risk and uncertainty

12. Capital investment decisions: appraisal methods

13. Capital investment decisions: the impact of capital rationing, taxation, inflation and risk

Part 4: Information for planning, control and performance measurement

14. Management control systems

15. The budgeting process

16. Standard costing and variance analysis 1

17. Standard costing and variance analysis 2: further aspects

18. Divisional financial performance

19. Transfer pricing in divisionalized companies

Part 5: Strategic performance and cost management for value creation; digitalization, sustainability and the future of management accounting

20. Strategic performance management

21. Strategic cost management and value creation

22. Management accounting – current technologies and data analytics

23. Sustainability and environmental management accounting

24. Overview and challenges for the future

Part 6: Addendum: The application of quantitative methods to management accounting

25. Cost estimation and cost behaviour

26. Quantitative models for the planning and control of inventoriescounting.